The DWP has very belatedly issued the interim review of the bedroom tax (under occupation penalty, removal of the spare room subsidy, whatever). The document can be found here, based on a survey for the period to April/Nov 2013.

And the results are… entirely predictable to everyone but the DWP.

Some headlines…

Social landlord rent arrears rose by 16% between April 2013 and November 2013. The report can’t quite bring itself to pin this on the bedroom tax, although noting that this was not a period of the year when arrears have traditionally risen, “it must be emphasised that the cause of this is uncertain and we cannot directly attribute this increase to the RSRS”.

Number of tenants who have been able to downsize (a stated aim of the policy): 4.5% (And this was the first rush, taking the available downsizing properties).

Number of tenants who have moved to the PRS (more expensively): 1.4%

Number of tenants subject to the bedroom tax who are in arrears because of it: 59% Yes, 59%.

Number of notices seeking possession served on ‘bedroom tax only’ arrears (to Nov 2013): 13,356 (10% of those affected)

Number of possession proceedings brought on ‘bedroom tax only’ arrears (to Nov 2013): 1,628

Number of suspended possession orders (SPO) (to Nov 2013): 407

Number of outright possession orders (to Nov 2013): 138

Number of evictions (on bedroom tax only cases): 45 (24 of these from a single landlord! This seems quite disproportionate. Who is this landlord?)

Interesting that the courts are making SPOs. I can see why – it is about the only tool they have to avoid an outright order, absent some detailed and difficult legal argument. But realistically, any SPO will be inevitably be breached in the large majority of cases. It is a very temporary sticking plaster, in the hope that something will turn up.

While the numbers evicted in the first 7 months are small (and apparently distorted by one particular landlord), the numbers starting the possession process (10% of affected tenants) in the first 7 months are significant. And remember these are ‘bedroom tax only’ arrears, not including those whose existing arrears position was tipped over the edge by the bedroom tax and facing claims or breached SPOs as a result.

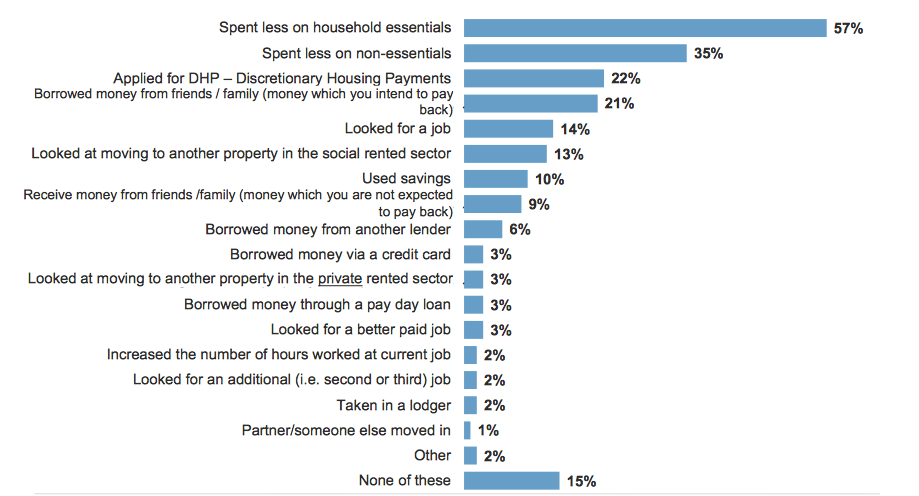

And how are tenants coping? Not well.

57% spent less on essentials (heating, lighting, food). Only 22% applied for DHPs, 21% borrowed money from friends and family.

And 68% reported that they or someone in their household had a disability, 58% receiving some form of care.

DHPs? Well… Tenants mostly didn’t know about them. The most vulnerable has no idea how to apply. Landlords complained of a lack of consistency across areas, many authorities lacked clear guidance or processes for deciding, and local authorities were taking disability benefits into account when assessing for DHPs (including DLA – roll on the judicial review of this!). The survey of councils showed that the very large majority (over 75%) included DLA in consideration of means. And some LAs, of course, refused DHPs to people who smoked or had televisions, on the basis that the poor should have no pleasures whatsoever.

Oh and of those tenants seeking work, or for more work/additional hours, 87% had been unsuccessful so far.

So, sneaked out on the day of the reshuffle, this basically confirms what we had all told the government before the regulations came in. The bedroom tax won’t work. It will cause unnecessary hardship and suffering and simply turn Govt HB spending into social landlord arrears and tenant debt. And those possession proceedings? Just the very start, the first ripples of the waves to come…

Here we have 163 pages and yet within that tome in a so-called ‘evaluation’ we find:

(a) No mention whatsoever of any savings, claimed or otherwise

(b) No mention that mobility (ie downsizing) rates actually REDUCED in 2012/13 compared with all of the previous ten years before the bedroom tax.

In short, a failed report of a failed policy.

How can any claimed ‘evaluation’ of the bedroom tax not mention savings at all. How can it discuss mobility rates yet not compare them to what they were before?

The aims presuppose and increase in mobility which means for anything to increase you must have a benchmark against which to judge any increase even a pre-supposed one. Yet the report does not do this!

This report is a total sham

Joe.

Savings were not part of the brief of the report, which is on implementation and operation. It is not an evaluation of policy, just operation.

Figures on mobility rates generally are simply not comparable. Mobility is not just downsizing, obviously. The figure of 4.5% is for the first 6 months, not the year 2013/14. The previous figure for downsizing given is 0.5% of ALL tenants (including pensioners etc.) so the report is careful not to draw a direct comparison, or state a simple rate increase. The only exact figure, which is the one that nobody has, would be downsizing rate of those who would be affected by the bedroom tax in 2012/13, compared to the rate for the same people in 2013/14.

You are aiming at the wrong targets.

I’m wondering is it possible to bring corporate manslaughter charges seeing as deaths resulting from the welfare reforms can be directly linked to such changes causing hardship?? Even if not there must be some laws that are designed to hold ministers accountable??

Can’t be linked directly enough. And, I’m afraid, there is no right to benefits.

It is very interesting in Gloucestershire and the West Midlands, where I have worked since the introduction of the regulations ending the ‘spare room subsidy’, that none of the Housing Associations has taken any steps whatsoever to assist its tenants facing bedroom tax issues. Where the rent arrears have been solely the result of the bedroom tax, I have been raising this with DJs in the County Court as a breach of the Pre-Action Protocol for Rent Arrears, with some success. One DJ waded into the particular HA, adjourned the case and gave directions that the HA must return to the next hearing having demonstrated that it had; 1. actively assisted the tenant to make a transfer application internally; 2. that it had actively assisted the tenant to make a transfer application via the CBL scheme; 3. that they had actively assisted the tenant to apply for DHP;

4. that the tenant had taken all steps to try and pay the shortfall and/or engaged with their landlord in the above activities.

That particular HA swiftly took action and the client was placed in Gold Band on the CBL. I don’t know whether he successfully downsized as I left the area.

It does seem to me that the HAs in particular have taken the collective view that it is a Government policy and that they are willing to see the worst effects of it come into play and just evict tenants, whilst leaving their poor tenants as the victims of the policy.

I’m in an inner London borough and that doesn’t seem to be true here. Arrears because of BT yes but HAs and council pro-actively trying to sort them out. I’ve seen no eviction processes purely on BT arrears (I’m a CAB adviser).

I think the stance and actions taken by social landlords vary widely. Sadly some do exactly as you say – nothing at all.

Giles

Go back to the impact assessment of June 2012 which is the remit for this alleged monitoring report. It is full of the main bedroom tax rationale for savings and also says (I have updated the blog with p42 of the impact assessment) that any link between bedroom tax and cuts (and ergo arrears) is a ‘straightforward’ link between the two.

The report says it is an ‘evaluation’ and you simply cannot have any evaluation of the bedroom tax that runs to 163 pages and fails absolutely to comment on any alleged savings. It is just not credible.

Conversely, how can any report into the bedroom tax commissioned by DWP fail to include ‘savings’ in its ToR? If as you maintain it does then that raise a whole host of other questions as to why the DWP explicitly wish for the alleged ‘savings’ not to be evaluated.

My comparison of ‘movement’ is the only credible comparison as while I agree the ugly crass term ‘downsizing’ was invented for the policy it was never recorded previously and only all mobility was recorded. The same impact assessment says 8% of social tenants moved in 2012/13 and the same DWP proclaimed the bedroom tax was a success back in April as 6% of social tenants moved. The bedroom tax has reduced mobility and has not freed up properties as it was intended.

The same impact assessment also suggested 10 – 15% of social tenants would take in a lodger and the policy would affect 660,000 households AND save the best part of £500m pa. So no comment in 163 pages on ‘savings’ has to be viewed correctly in that context

Joe, you are simply not reading the report. Read page 13 which sets out the objectives. It is a report on the implementation and operation of the bedroom tax. It is not an evaluation of the policy.

You can stamp you foot as much as you like, but you are simply saying the report doesn’t investigate things that you think it should investigate. It is frankly ludicrous to accuse the report’s authors of a cover up and whitewash because the terms of the report that they were set to deliver does not do what you think it should do. It is not a policy review. Pure and simple.

Now, on the figures, I agree that a full scale assessment should consider the effect on overall mobility – and also on people gaining access to social housing for the first time. Those figures, even if available, would take time to trickle through and become available. The report doesn’t address that because it can’t yet, but does mention social landlords concerns about this.

The 0.5% downsizing figure is from the landlords’ downsizing registers. It therefore gives those looking specifically to downsize, rather than move in general. But, for the reasons I gave above, it is not a direct like for like match. The general ‘moving’ figures are meaningless as a comparison, when the figure here – the 4.5% is specifically downsizing (and that is a term that has been in use for a long time!).

The report does not say that there has been an increase in downsizers. Nor does it give a figure for that increase. It simply presents the figures that are the closest comparators, while acknowledging that they are not the same. It would not surprise me if there had been an increase in downsizing, but a) 4.5% is tiny & b) those will be the early ones where property is actually available, so that figure may well tail off quite rapidly after an initial ‘wave’.

I am puzzled by your hostility to the report, frankly. It shows, pretty damn conclusively, what the problems are that the bedroom tax has caused, for tenants and landlords, and that they aren’t going away.