It has been one of those days, where a couple of things caused gnashing of teeth at the state of the world, or at least that (smallish) bit of it that involves the practice of housing law. So, I am going to vent. Apologies in advance.

Firstly, I am trying to issue an urgent interim injunction application, related to Awaab’s Law and an emergency hazard. All very exciting, except…

My paralegal, after lots of trying, this morning got through to the number for counter appointments at Central London County Court. (For anyone not acquainted with the current County Courts, you can’t just go along and file an urgent application, oh no, there is no open counter to do that. You have to make an appointment. There are a limited number of appointments that can be booked.) She was asked for the defendant’s postcode and then immediately said it wasn’t Central London’s jurisdiction, she’d have to go to Clerkenwell & Shoreditch County Court. (Remember that thing called the Unified County Court? Apparently no longer exists).

My long suffering paralegal then eventually got through to Clerkenwell & Shoreditch to make an appointment. Clerkenwell refused to do so because apparently they don’t have any Judges for urgent applications at all. We would have to go to Central London, she was told.

Back she duly went, with the patience of a particularly patient saint, to the Central London counter appointments line. Having eventually got through, she explained what Clerkenwell had said. She was grudgingly given an appointment for tomorrow (or today if you are reading this by email), but, she was told, but it wouldn’t be treated as an urgent application and would probably be transferred to Clerkenwell & Shoreditch.

What, I ask rhetorically, is the bloody point in trying to do anything in the civil justice system?? A basic function of the County Court, dealing with urgent applications that are urgent for very good reasons, becomes impossible. A shiny new law which creates an obligation on social landlords to act urgently, and in some cases within 24 hours, becomes absolutely unenforceable in practice because any application to do so via interim injunction won’t be heard within weeks or months,

Don’t even start me on the now routine delays and poor administration on any County Couryt civil case these days – waiting for directions orders, directions orders received after the time to comply with them has passed, applications and claims dismissed because of hearings that neither party was notified about, the black hole between filing pre-trial checklists and receiving, if you are lucky, a trial date. These are immensely frustrating to us and to clients, but can be managed, more or less. Though the managing of it is stretching to breaking point on a daily basis.

But not to be able to perform the basics of an urgent interim application where people are at significant risk, this undermines the fundamental principle of civil justice. Civil justice, at least at County Court level – which is the massively largest part of it – is broken.

I should be clear that this is not about the staff of the County Courts. It is about a system that has been underfunded, ignored and subject to staffing policies (including getting rid of the most experienced) that have brought the courts to beyond breaking point.

We will see what happens tomorrow (or today if reading by email).

(Deep breathing interlude).

Secondly, this 26 November 2025 notice from the SRA came to my attention. Surprise, surprise, a housing conditions claims farmer website called ‘Housing Disrepair Claims Specialist’ at housingdisrepairclaims.uk claimed that they were regulated by the SRA. Now, claims farmer sites being misleading about who they are is hardly a new thing (see my rant from 2019, with receipts), but this site co-opted a) the name of a firm of solicitors, and b) the name of an actual solicitor at a different firm (which does housing conditions claims, apparently in bulk), and c) the SRA ID number of the firm to which that solicitor belongs.

The SRA note says

The SRA authorises and regulates a genuine firm of solicitors called Veritas Solicitors LLP. The SRA ID for the firm is 472036. The SRA authorises and regulates a genuine solicitor called Faraz Fazal who is a Managing Partner at Veritas Solicitors LLP.

The SRA also authorises and regulates a genuine firm of solicitors Fountain Solicitors.

Veritas Solicitors LLP, Fountain Solicitors and Faraz Fazal have confirmed they do not have any connection to the alert above.

So, all those apparently referenced denied any connection.

Obviously no claims farmer can claim to be SRA regulated, unless they are actually part of an SRA regulated firm, which would present that firm with problems, because most of the things that claims farmers do are absolutely outside the Solicitors Code of Conduct (bluntly, that is the point of them. Even though the SRA has said that no regulated firm should take leads/clients from a claim farmer if the farmer’s activities are outside the solicitors’ code of conduct – possibly an act of regulatory over-reach, but stated nonetheless. Though so far not significantly acted upon, despite many examples).

So, either housingdisrepairclaims.uk was lying outright, or very very stupid about the extent of any connection.

What has apparently happened since the SRA note is that the site now states:

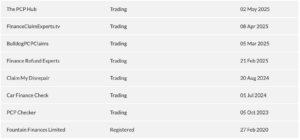

This site is owned and operated by Fountain Finances Limited which is registered in England and Wales. Registered number: 08069774. Registered office: 1D MacLaren House, Talbot Road, Old Trafford, M32 0FP. Fountain Finances Ltd. is authorised and regulated by the Financial Conduct Authority in respect of regulated claims management activity. FRN: 836354.

This may or may not be accurate, of course, given the history of false claims by housing disrepairclaims.uk. If Fountains Finances Ltd disclaim any relation to that site, please let me know.

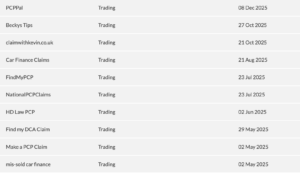

But, given the SRA note, one can only hope that the FCA take a close look at Fountain Finances Ltd (sole current director a Mr Andrew Montgomery), who, it appears, do a lot of claims farming

(I would be somewhat surprised if the FCA did act. So far it appears to believe its regulatory responsibilities extend to having a list of registered claims farmers and no further. But we live in hope.)

The trouble for Mr Montgomery’s set up (if it is them) is that they are also both lazy and stupid, because the ‘Complaints’ page (linked to twice in the footer) currently says variously

3.2. If you do not feel able to raise your concerns with either of these people, or you are unsatisfied with their response, please contact The Complaints Partner who has overall responsibility for complaints and whose contact details are:

-

- Mr Faraz Fazal

- Solicitor and Managing Partner

- Ffazal@Fountain Financessolicitors.co.uk

And

5.1. If you are unhappy with the outcome of our complaints handling procedure, please first let us know and we will review the matter.

5.2. We have eight weeks to consider your complaint. If we have not resolved it within this time you may be able to complain to the Legal Ombudsman. This applies if you are an individual, a business with fewer than 10 employees and turnover or assets not exceeding a certain threshold, a charity or trust with a net income of less than £1m, or if you fall within certain other categories (you can find out more from the Legal Ombudsman). The Legal Ombudsman will look at your complaint independently and it will not affect how we handle your matter.

And

6.1. The Solicitors Regulation Authority can help if you are concerned about our behaviour. This could be for things like dishonesty, taking or losing your money or treating you unfairly because of your age, a disability or other characteristic.

6.2. Visit its website to see how you can raise your concerns with the Solicitors Regulation Authority.

Fountain Finances Solicitors: Cardinal House, 20 St Mary’s Parsonage, Manchester, M3 2LY. Company Registration number: OC332899

Fountain Finances Solicitors is authorised and regulated by the Solicitors Regulation Authority under registration number 472036

(PDF for when this inevitably vanishes)

So still carrying out the misrepresentation in the SRA note. If I was Faraz Faral and I had no involvement with this set up, I would be blisteringly and litigiously furious. No doubt he is.

If I was a firm taking referrals from housingdisrepairclaims.uk I’d stop immediately – clearly you would be in breach of the code of conduct, given the SRA note.

In the context of the MHCLG/MoJ call for evidence on ‘housing disrepair claims’ (sic) this is all very depressing. I will be coming back to the call for evidence in the near future, because there is a lot to talk about. But limited action or inaction by regulators is not a great start.

In the meantime, I am so very, very tired of these shonky setups and any associated solicitors firms entering our sector, and so tired of having to try to put things right for tenant clients they have let down.

0 Comments