First Tier Tribunal LON/00AH/LSC/2017/0435 – Firstport Property Services Ltd v various leaseholders of Citiscape

We previously saw the Salford decision on the costs of a ‘waking watch’ in a tower with ‘Grenfell’ style cladding, but this was the first, keenly awaited, decision on the liability of leaseholders of an affected building (here in Croydon) to pay for the costs of removal and replacement of such cladding under their leases.

Before going into the details, we should be clear that a) this is a non-binding first tier tribunal decision, b) it turns wholly on the specific lease clauses and the specific facts, c) it is not a precedent in any way, shape or form. That said, to the extent that there are similar clauses in other leases for other buildings, it is suggestive of how they will be interpreted by the Tribunal.

Citiscape, a private block, has Grenfell style cladding. Leaseholders were being asked to pay an estimate of £483,000 for the removal and replacement of the cladding, with a further £1.5 million to £2 million charge to follow. There is also a waking watch at a cost of £263,000 per year, charged to the leaseholders. It was a tri-partite lease, with all maintenance etc. responsibility for the block given to the management company, and none left on the freeholder.

The Tribunal was asked to decided whether the waking watch charges were payable and/or reasonable and whether the estimated advance charge for cladding was payable and (oddly) reasonable.

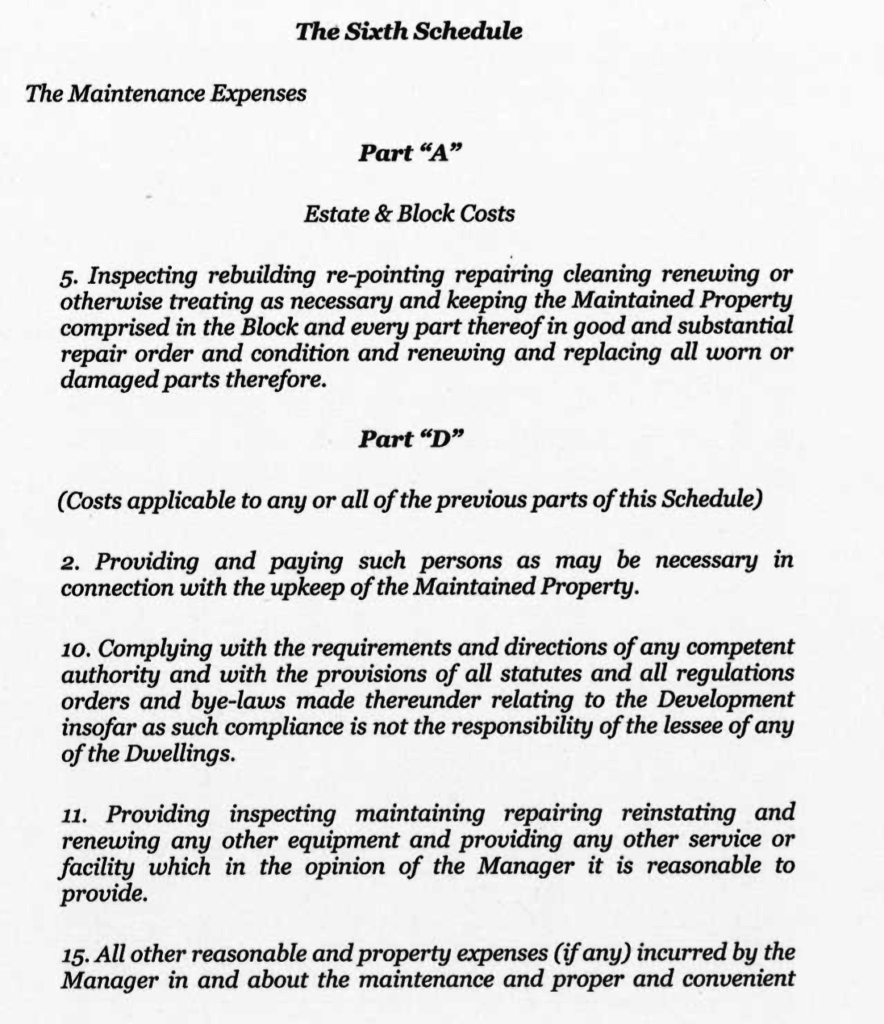

The relevant lease provisions were in the Sixth Schedule to the lease – expressed as bot the duties of the managing agents and costs of which were recoverable as service charge (if reading by email, load images):

It was clearly a long and difficult hearing (for an account, see here). But in the end, as I predicted, it came down to two real issues on the cladding. Was there any other plausible source of funds, and did the lease cover such costs.

The waking watch – as with the Salford case – was found to be payable as a cost falling under ‘the requirements and directions of any competent authority’, here the London Fire Brigade. But also falling under ‘the maintenance and proper and convenient management and running of the Development’ (and probably also under ‘providing and paying such persons as may be necessary in connection with the upkeep of the property’.) The costs of the waking watch were found to be reasonable in the absence of any evidence of significantly cheaper alternatives.

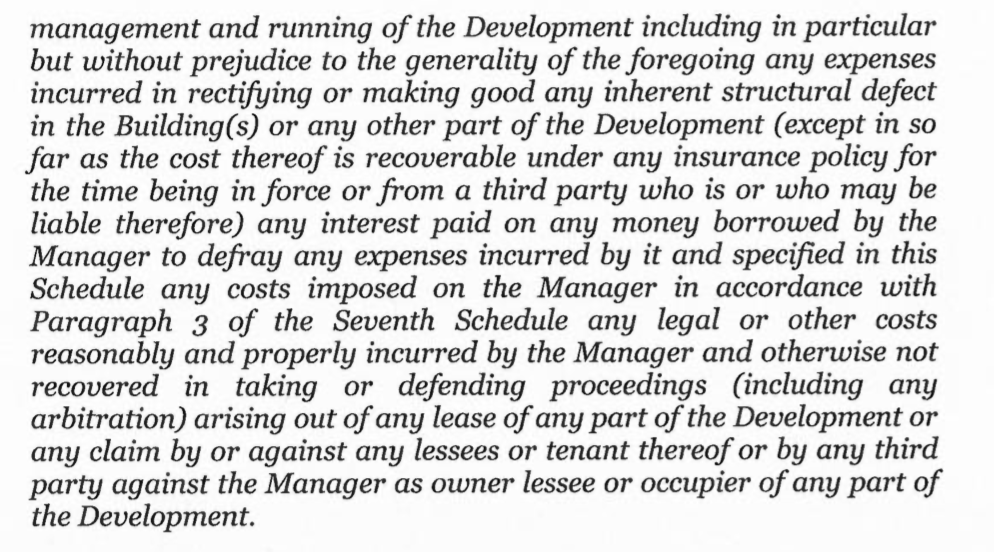

On the cladding removal, the leaseholders argued that it was not a repair or maintenance cost, as the cladding was not out of repair. The Tribunal accepted the decision in Credit Suisse v Beegas (1994) 4 All ER 803 in which Lindsay J found (image):

In the lease ‘renewing or otherwise treating as necessary’ went beyond simple repair. Equally ‘in good and substantial repair order and condition’ went beyond simple repair. The fire risk from the cladding meant the blocks were not in such a condition. Further ‘rectifying or making good any inherent structural defects’ would also encompass removing the cladding, and by para 15 of the lease, the managing agents were obliged to do this, and so the leaseholders obliged to pay for it.

On the argument raised by leaseholders that the costs should not be payable by the leaseholders where the freeholder or managing agent could otherwise recover them through insurance or other means, this was in principle correct. But the managing agent had sought payment from the developer and the freeholder, and the insurer, and had been rebuffed. The leases could not be considered to have contemplated a requirement to resort to litigation. ‘Recoverable’ under insurance could not be extended to speculative litigation, but meant an insurance claim with a degree of certainty.

So, the costs were recoverable under the leases. The challenge to the ‘on account charge’ as being far to little to meet the actual costs also failed, as it was based on an urgent estimate.

The leaseholders are on the hook for the costs of removing and re-cladding, subject only to any challenge to the actual costs.

Comment

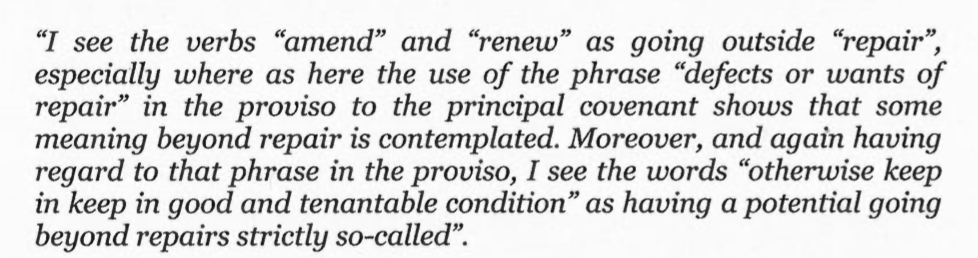

It has to be said that para 66 of the decision has brought about a lot of excited comment (picture).

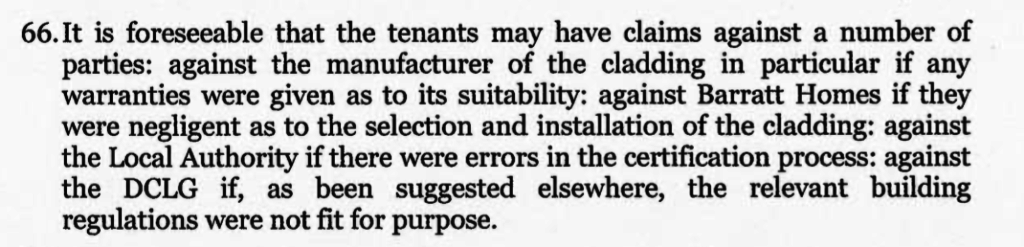

People have read this as the Tribunal Judge saying that there were such possible claims. He wasn’t. It would not be his role to decide or suggest any such thing. He was responding to suggestions by leaseholders of the possibility of such claims as a reason for the service charges not being payable. The next paragraph makes this clear (picture):

Of course, there may be future claims (though how the leaseholders would and could bring them is very far from clear). And if the claims are successful (a very big if) then the leaseholders could look at recompense. But it is important to be clear that the Tribunal Judge was not saying that such claims were either possible in law, or had any prospects of success. That was simply not an issue on which the Judge could, should or did decide.

For leaseholders in affected blocks – depending on the lease – the future does not look at all good. And of course, the properties are unsaleable in the meantime.

Giles I wonder if you can comment, since Grenfell my Housing Association have been taking fire regulations seriously (according to the people who have been coming to the small flat block I live in (3 blocks of 8 flats over just 4 floors) to carry out inspections.

Well last year we saw a 50% increase in our service charge, I queried this and was given a breakdown, one of the things they referred to was fire regulations which they said cost them the equivalent of £400 a year but they could not charge that so made a so called nominal charge.

Well this year they have done it again, ANOTHER 50% increase, I note that they have renamed Fire Regs to Health & Safety.

I am just wondering if there is some legal thing I can refer to to get them to revise this effective increase of 100% in two years?

It seems to me that they are expecting us to pay for their obligations, like most quasi public sector type organisations they have the disease of spending other people’s money. Their contractors also seem to be exploiting them, report a car park light bulb needs replacing and they change the whole fitting and drag it out to two days for extra call out charge.

Last year they also added a new charge for a superior landlord who had never charged before and does not do gardening maintenance on any of the social housing beds, yet now want us to contribute to their grounds maintenance despite that fact that we pay for our own. The HA did not bother to dispute this but just passed it on. Again, anything legal you could refer me to to would be very helpful.

Thanks for your help, Fantastic blog

Have a look at the Lease advice site.

https://www.lease-advice.org/

We don’t do individual advice via the site, I’m afraid.

Hi Giles

I know you do not offer individual advice but perhaps you could comment generally about social housing companies pushing down fire fees to tenants via service charge or about them increasing service charges generally and legally what limits are in place?

BTW your subscription to comments does not work, I get

“Sorry, but the provided signature isn’t valid.”

All of that is on the Lease advice pages. It is a big topic, so no, I can’t comment generally. But there aren’t any limits, per se, save that they have to be genuine costs recoverable under the lease.

Thanks – that is odd. Not had any other reports of issues.