This is not a usual blog post. I was asked to do an analysis of the proposed £23,000 pa benefit cap, its impact on housing, homelessness and the legal position, with a focus on London, for use elsewhere and for a purpose which shall remain nameless. But I feel this needs wider sharing.

I analysed the likely effects based on all the available information I could find, which is sourced. In doing so, I was replicating much of the work done by Joe Halewood, but my analysis is my own, based on the available figures and to the extent that I come to similar conclusions to Joe, simply confirms the position. The focus on London was because of the nature of the request made to me. However, the impact on the rest of the country will be significant. While London may continue to be the most affected region, the effect on areas out of London will be much greater than the £26,000 cap. Some of the ‘out of London’ effect is mentioned and more can be deduced from the data in this post.

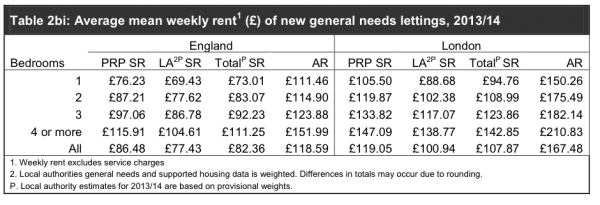

I should also make clear that this is a very conservative view. For example, the social/affordable average rent figures used are from 2013/14, not 14/15, let alone 15/16. These were the most recent set I could find. My figures for HB shortfalls should be considered as certainly understated for that reason. I have also taken no account of rent increases, or benefit increases over subsequent years from the likely introduction of the £23,000 cap. This will undoubtedly, inevitably, mean that the situation worsens and shortfalls increase.

Finally, this is not a rant about the merits or otherwise of the cap. It is an analysis of the most likely factual outcomes.

Summary findings

Numbers subject to the current £26,000 cap have remained fairly constant since introduction, despite a flux of over half the cumulative total. Those households no longer subject to the cap have therefore largely been replaced by households newly subject to the cap. There is no reason to believe that a reduced cap would have a different pattern.

Households can be subject to the cap for a period of unemployment, of months or weeks (after an initial grace period of 39 weeks if employed for 50 of the previous 52 weeks). But rent arrears will accrue during that time (as it is housing benefit that is capped in practice).

On a reduced £23,000 cap, some households (2 parent, 3 child & single parent, 4 child) would received housing benefit payments significantly lower than the London social rent for a 3 bedroom or 4 bedroom property. For both types of household, the housing benefit payment would be lower than the out of London social rent for a 4 bedroom property, and for a single parent 4 child household, lead to a shortfall on a 3 bedroom property, giving rise to the real possibility that for some of these households, no adequately sized social property in England would be affordable.

On a £23,000 cap, a 2 parent, 2 child household would have a significant shortfall in housing benefit on rent due for a 2 bedroom or above London ‘affordable rent’ property.

No private sector accommodation in London would be affordable to households with two children subject to a £23,000 cap.

At a £23,000 cap temporary accommodation for the homeless in London, at current rent rates, is in excess of benefit capped housing benefit for any household with more than 1 child, presenting a severe financial and resource problem for Local Authorities.

DHP funding to Local Authorities has been cut by £40 million in 2015/16.

An estimated 90,000 additional households would be subject to a £23,000 cap, giving a total of some 110,000 households. An estimated 60% are in private sector accommodation and 40% in social accommodation. Some 20% of households receiving out of work benefits (and so subject to the cap) have 3 or 4 children. A further 31% have two children.

London would be worst affected, with an estimated 40,500 households subject to a £23,000 cap. There is a clear risk of some 6,000 or more households being made homeless from private sector accommodation within a year, leading to a 35% increase in homeless applications to Local Authorities. Households of a type potentially subject to the £23,000 cap, should they become unemployed, will be viewed as a risk by private landlords and have difficulty in finding accommodation. Eviction from private sector tenancies as a cause of homelessness have risen from 11% of those accepted as homeless in 2010 to 39% of those accepted in Q4 2014. This will rise further.

Eviction due to benefit cap based arrears should not be classed as intentional homelessness and Local Authorities would owe the full housing duty to those households, placing a huge strain on an already overburdened system, with the added difficulty of being unable to provide temporary accommodation without further subsidy from Local Authority funds.

Longer term, social housing providers in London will see increased arrears from some households subject to the cap, even of only for a few months of unemployment. More than two or three months of unemployment (after any grace period) could easily give rise to arrears of rent of a level where social landlords would take possession proceedings.

Even where arrears don’t lead to possession proceedings by social landlords, the fairly constant level of those subject to the cap will mean a consistent increase in arrears, even if spread over disparate households. Social landlord will likely always have a percentage of tenants subject to the cap and with a shortfall in housing benefit, even if the specific tenants change.

A £23,000 cap may lead to further judicial review proceedings on the basis that it effectively excludes certain households, principally but not exclusively single parent households, from affording any form of rented accommodation, private, affordable or social.

Sections

A. Overview of statistics on current £26,000 cap

B. Social and Affordable rent levels

C. Impact of £23,000 cap on social and affordable rent households

D. Numbers of households affected and composition.

E. Homelessness. Impact on Local Authorities.

F. Legal position and prospective challenges.

A. DWP statistics and ‘off flows’ on £26,000 cap from April 2013 to Feb 2015

- The overall number of households subject to the £26,000 benefit cap at any point in time has decreased by approximately 5450 households since a peak of 28,434 in December 2013 to 23,093 at February 2015. (Source: https://www.gov.uk/government/statistics/benefit-cap-number-of-households-capped-to-february-2015 )

- The DWP asserts that a cumulative total of 58,700 households have been subject to the cap. Of those leaving capped status, some 35,600 households cumulatively, 14,400 households were recorded as subsequently receiving working tax credit. The DWP ‘off-flow’ figures for Job Seekers Allowance state that between 90-94% of claimants ended a JSA claim within 12 months. (NB, this is not a record of moving into work, nor does it include people returning to JSA after a short period. Figures given here suggest 68% of those leaving JSA enter paid work. But “just 36% of JSA claimants will find a job within six months and remain employed for the following seven or eight months”).

- In February 2015:

83% of capped households were capped by £100 or less a week.

59% of capped households had between 1 and 4 children and 35% had 5 or more children.

63% of capped households constituted a single parent with child dependants.

- What these figures show is that while there is considerable movement out of capped status for various reasons, there is also considerable movement into capped status over the same period. The reduction in ‘point in time’ households capped is less than 10% of the cumulative number of households subject to the cap, and the ‘point in time’ total at February 2015 is 81% of the ‘point in time’ peak.

- In short, the numbers subject to the benefit cap remain fairly constant. There is movement into employment and changing household composition. There is also loss of employment and entry into jobseekers benefits (after any grace period), and changed household composition (a new child, for example) that make people freshly subject to the cap.

- On the DWP’s figures, it is clear that households are often subject to the cap for some months of unemployment, or become subject to it through unexpected household change. But a period of a 3 months on a capped deduction of £100 per week, for example, could amount to rent arrears of £1300.

- The decrease of some 5450 households from the peak figure is largely accounted for some 4000 ‘no longer claiming housing benefit’. These are not households with working tax credit claims, or in receipt of an exempt benefit, or with a changed household structure. They have no recorded post cap status. While it is possible that some households found employment at a level that would exceed tax credit entitlement, or housing benefit entitlement, it is unlikely that this would be the case for 4000 households. These households have, in effect, vanished.

- On the reasonable presumption that similar flows out of and into capped status would also apply to a £23,000 cap, and on the basis of an estimate of an additional 90,000 households subject to the cap, this would suggest a fairly continual rate of some 110,000 households subject to the cap at any point in time.

B. Social and Affordable rents

In 2013/14

London 3 bed Social Rent – £123.86

London 3 bed Affordable Rent – £182.14

London 4 bed Social Rent – £142.85

London 4 Bed Affordable Rent – £210.83

C. Impact of £23,000 cap on social and affordable rent households

Examples – London

Social rent

2 parent 3 child household

2 parent 3 child household gets £334.56 per week in welfare benefit and child tax credit (not including Housing Benefit)

Max benefit income under £23,000 cap = £442.31

Max Housing Benefit payable under cap = £107.75 per week

Shortfall in social rent on 3 bed property (at 2013/14 rents) = £16.11 per week

Shortfall in social rent on 4 bed property (at 2103/14 rents) = £35.11 per week

(NB Out of London Social rent 4 bed is shortfall of £3.50 per week)

1 Parent 4 child household

1 parent 4 child household gets £359.86 per week in welfare benefit and child tax credit (not including Housing Benefit)

Max benefit income under £23,000 cap = £442.31

Max Housing Benefit payable under cap = £80.93 per week

Shortfall in social rent on a 1 bed property (at 2013/14 rents) = £13.83 per week

Shortfall on a 2 bed = £28.06 per week

Shortfall on a 3 bed = £42.93 per week

Shortfall on a 4 bed = £61.92 per week.

(NB Shortfall on Out of London 3 bed social rent = £11.26 per week, and on an Out of London 4 bed shortfall = £30.32 per week.)

Affordable rent

2 parent 2 child household

2 parent 2 child household gets £267.42 per week in welfare benefit and child tax credit (not including Housing Benefit)

Max benefit income under £23,000 cap = £442.31

Max Housing Benefit payable under cap = £173.37 per week

Shortfall in affordable rent on 2 bed property (at 2013/14 rents) = £2.12 per week

Shortfall in affordable rent on 3 bed property (at 2013/14 rents) = £8.77 per week

Shortfall in affordable rent on 4 bed property (at 2013/14 rents) = £37.46 per week

(London ‘affordable rent’ was at an average of 50% of private market rents in 2013/14.)

D. Numbers of households affected.

- In 2012 – households in receipt of out of work benefits

With 2 children – 30.97% (419,370)

With 3 children – 14.34% (194,370)

With 4 children – 5.63% (76,310)

(source: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/223241/foi_3222_2012.pdf )

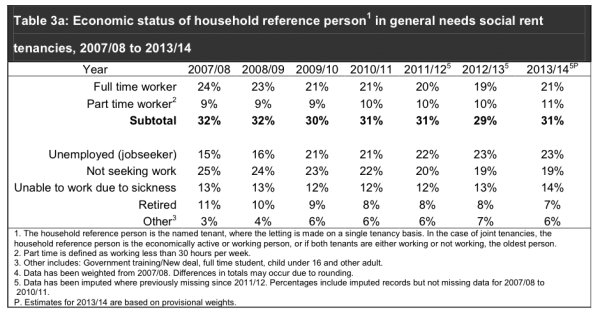

- Social Housing tenants – economic status.

- As of 2013/14 42% of general social housing tenants are either unemployed jobseekers (23%) or not seeking work (19%). A further 14% are unable to work due to sickness.

- An estimate is an additional 90,000 households will be subject to the cap at £23,000 (source – National Housing Federation). The estimate suggests 60% will be in private tenancies and 40% in Council or Housing Association tenancies.

- Given that 45% of those affected by the £26,000 benefit cap were/are in London, it is reasonable to assume that a similar or greater proportion of those subject to a £23,000 cap will be in London, given the higher London private, affordable and social rents. This would mean at least 40,500 households in London.The DWP figures for households affected by the £26,000 cap are:

59% of capped households had between 1 and 4 children and 35% had 5 or more children.

63% of capped households constituted a single parent with child dependants.

(Source: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/426846/benefit-cap-statistics-to-feb-2015.pdf )

There is no reason to believe that a £23,000 cap would not have a similar disproportionate impact on households with children and single parent households in particular, across a further estimated 90,000 households.

E. Homelessness and impact on Local Authorities

i) Temporary accommodation

- Temporary accommodation arranged by Local Authorities in satisfaction of their obligations to homeless households under s.188 and s.193 Housing Act 1996 is not exempt from the benefit cap.

- Temporary accommodation in London currently (January 2015) costs as follows:

Self contained

Studio £35 per night (£245 pw)

1 bed £36 per night (£252 pw)

2 bed £45 per night (£315 pw)

3 bed £55 per night (£385 pw)

4 bed £64 per night (£448 pw)Shared

1 bed £27 per night (£189 pw)

2 bed £35 per night (£245 pw)

3 bed £43 per night (£301 pw)

4 bed £48 per night (£336 pw)

(Source Pan London Nightly Rights Agreement review)

- This makes suitable temporary accommodation unaffordable for all but single and 1/2 parent, one child households when subject to the £23,000 cap. Any households with 2 children or above face a large shortfall on self contained 1 bed or above, and 2 bed shared or above.

- The £23, 000 benefit cap would cause very severe difficulties for Local Authorities in finding temporary accommodation for homeless applicants and their households, if they were subject to (or became subject to) the benefit cap. The usual emergency and temporary accommodation utilised by London councils for homeless applicants would be unaffordable for a large proportion of applicants and for that reason not suitable accommodation.

- The provision of temporary accommodation is currently funded through housing benefit. If no accommodation is available that would be suitable (as affordable) for the household, there is a clear and significant problem for Local Authorities in fulfilling their obligations.

- The case of R (OAO Yekini) v LB Southwark [2014] EWHC 2096 (Admin) is worth noting in this regard. In this case, the High Court held that s.206 Housing Act 1996 made levying a charge for temporary accommodation a discretion, not an obligation, and that a peppercorn rent would in any event be legitimate under s.206(2)(a). It would be lawful for a Local Authority to charge a reduced, or nil rent if that were the only way to meet its obligation to provide accommodation (or the rent could be funded under section 17 Children Act 1989). A homeless applicant not being able to afford the standard rent charged for temporary accommodation does not end the Authority’s obligation to secure accommodation for them. The implications for Local Authority resources are self-evident.

- DHP funding to Local Authorities by the DWP has been cut from £165m in 2014/15 to £125m in 2015/16 (source http://www.insidehousing.co.uk/dwp-cuts-discretionary-housing-payments-by-40m/7008045.article) DHP also has to fund bedroom tax rent shortfalls for disabled and others.

- This problem will be compounded for Local Authorities seeking to discharge their housing duty by providing the homeless household with permanent accommodation in social housing. As identified above, some households will not have the income necessary to make social housing of adequate size affordable. A property that is unaffordable is not suitable and as such, is not adequate for the Local Authority to discharge its housing duty under Part VII Housing Act 1996.

- If the Local Authority is unable to discharge its duty by an offer of suitable social housing, as would be the case for 3 or 4 child households subject to the cap, it is very difficult to see how the duty can actually be discharged at all.

ii) Increase in homeless applications

- If the projection is correct that at least 45% of households affected by a £23,000 benefit cap will be in London (and it is probably higher, given rent levels), that will amount to some 40,500 households. If the national estimate is replicated in London, some 60% of those will be in private tenancies.

- On the calculations above, it is clear that for a household with two or more children, all adequate private sector and much affordable housing will be unaffordable. For households with two adults and 3 or more children, and single parents with four or more children, adequate social housing will also be unaffordable.

- Even a period of a few months unemployment could result in significant rent arrears, almost certainly giving rise to the termination of private sector tenancies and quite probably ‘affordable’ and social tenancies as well, albeit more likely over a longer timescale.

- There is a significant risk that private sector landlords will aim to avoid letting to anyone who is perceived to be at risk of being subject to the benefit cap, particularly low earning households with children, already receiving housing benefit, and that existing tenancies will be terminated to avoid the perceived risk. Eviction from a private sector tenancy is already the largest single cause of homelessness at 29% nationally and 39% in London n Q4 2014 (the London figure in 2010 was 11%) (source https://www.gov.uk/government/statistical-data-sets/live-tables-on-homelessness )

- Households with children who are threatened with homelessness will, subject to eligibility, be owed the full housing duty by Local Authorities under Part VII Housing Act 1996, unless the applicant is found to have become intentionally homeless.

- Eviction due to arrears of rent is commonly held to be intentional homelessness by Local Authorities. However, this is not the case where the shortfall in rent was not caused by an act or failing of the applicant and the rent due was genuinely unaffordable. Arrears accruing largely or solely as a result of a shortfall in housing benefit due to the Benefit Cap will, in the large majority of cases, be unintentional.

- Local Authorities across London will inevitably face a very significant rise in homeless applications by households with children who are subject to the benefit cap.

- There can be no precise projection. From this report, it appears that 1 in 6 (17%) of those in private sector accommodation and subject to the benefit cap of £26,000 in London Borough of Wandsworth were accepted as homeless. This proportion can reasonably be expected to rise given both the greater numbers affected and the increased level of shortfall in housing benefit/LHA against rent. If 25% of those currently in a private sector tenancy in London, and who would be subject to a £23,000 cap, apply as homeless in a year, this would amount to some 6,000 homeless applications. In 2014, London councils accepted 17,060 homeless applications in total. A further 6,000 would amount to a 35% increase in a year, an unsustainable figure. (source for 2014 figures https://www.gov.uk/government/statistical-data-sets/live-tables-on-homelessness ).

F. Legal Position and prospective challenges.

- The main challenge to the existing benefit cap regulations was SG & Ors, R (on the application of) v Secretary of State for Work and Pensions (SSWP) [2015] UKSC 16

- The Supreme Court rejected a challenge to the £26,000 benefit cap regulations as being disproportionate in their discriminatory impact on women, in breach of Article 14 ECHR. Two key grounds for the rejection of the challenge were the availability of DHPs to mitigate the impact on, for example, those in temporary accommodation or fleeing domestic violence, and the relation between the amount of the cap and the average household income (before in-work benefits). Both of these will change for the £23,000 cap. There is no relation to average income and the DHP funding to Local Authorities has been reduced by £20 million.

- However, it is unlikely that a challenge to the new regulations would succeed on exactly the same ground.

- A related argument that Article 14 should be read as including Article 3(1) of the UN Convention on the Rights of Children – the duty to have regard to the best interests of children. While 3 of 5 judges found that the Secretary of State had “failed to show how the regulations are compatible with his obligation to treat the best interests of children as a primary consideration”. However, one of those 3 also found that as an unincorporated treaty, the UNCRC could not be relied upon in the UK courts, and so this ground also failed, 3-2. There can be no further appeal on this ground.

- Given the likelihood, set out above, that certain households (two parent three child, one parent four child) will face a significant shortfall on rent in virtually any form of accommodation (private, affordable or social) in London or potentially the rest of the country, it is very likely that a further challenge to the revised cap regulations will be brought on grounds of disproportionate interference with Article 8, in conjunction with Article 14 and Article 1 Protocol 1.

Excellent. You should send this to Andy Burnham, and see if he still refuses to rule out supporting hte £23,000 benefits cap.

Nice piece and well sourced and just a couple of general points.

1) The rents quoted are for 2013/14 and social rents increased by 3.7% in 14/15 and then by 2.2% in 2015/16 taking the figure for a 3 bed social rent from £123.86 to £131.27 currently; and the 4 bed from £142.85 to £151.40 currently.

The benefit freeze announced in Queens Speech is for 2016/17 and 2017/18 meaning that today’s single persons JSA of £73.10 will be the same £73.10 right up to April 2018, in which time rents will have increased by CPI+1% in April 2016 and again in April 2017.

So the numbers affected and the scale of the shortfall increases year on year.

2) The impacts are impossible to predict. In flat cap and whippet country here oop North – or for that matter the 83% of social housing stock that is not in London and subject to its perverse housing situation – the reaction of the private landlords to this is open to huge conjecture.

Unlike London social rents are not that far removed from private rent levels and even in the odd case more expensive than PRS rents, but generally only 10% – 25% higher as a good average range.

For example the 2 bed LHA rate in Liverpool is £454 pcm and there are about 100 3 bed properties regularly available for that and even some 4 bed properties. It is likely the private landlord with such 3 and 4 bed properties will directly under occupy with those of a 2 bed need – the 1 parent 1 child – for whom the LHA will cover the full rent even for a 4 bed and no threat as to benefit cap and of course the bedroom tax does not apply to private tenants.

That must read as bizarre to those used to London’s crazy rent levels but a common issue in the majority of the country.

Will the PRS landlord bother to find out if his tenant is on ESA and in the support group and thus exempt or whether on ESA and in working group and liable? Or will he just decide all ESA claimants are too much of a risk and issue S21s like confetti? I suspect that will happen and an even greater increase in homelessness will follow.

As I say this is so complex to assess the impacts upon homelessness and that is without mentioning the withdrawal of housing benefit to those under 21….

Oh happy days!

Thanks Joe. Following in your footsteps. Yes, the social rents went up, but I wanted the full in/out of London and Affordable average figures. I agree the shortfalls are bigger than my examples because of that, and also that the shortfalls will rise.

Agreed that the situation outside London, particularly PRS, will be far more variable and unpredictable.

Where do the non-high earners you know who don’t receive hb live?

In London?

Well, I have one client who squats (industrial property of course).

One of our tenants is working three jobs to earn £12K and is not eligible for WTC or HB. She should be receibing LLW on one job, but is not yet. She has (barely) grown-up sons who can’t quite understand the concept of regular payments and overall they can’t clear historic arrears. I suspect that’s not unusual and others will have much worse examples. This is in London.

Someone needs to look into those 4,000 ‘disappeared’ families.

Whatever actually happened, some of those households will have experienced very unpleasant outcomes.

Here in the South East private landlord and their rents far exceed cap. 3 bed in my area east sussex £900 -1100. Social housing is low, affordable housing starts at 230000! How is that affordable when average wage is minimum wage, mortgage is not affordable. Homeless and mental health serious increase . I see it imploding. Most private affordable taken by non UK residents. Heading for what can only be described as a type of segregation happening .

If I’ve understood your calculations of rent shortfall correctly, you have assumed the only housing benefit will be used to pay rent, and no other income will be spent on rent.

Is that correct?

And if so, is that because there is some legal reason why other benefits can’t be spent on rent, or have you just assumed that at those levels of income money is sufficiently tight that there will be none left for rent?

The latter. Social landlords experience of arrears through bedroom tax supports it. When you are looking at households on subsistence level benefits (JSA, Income Support, ESA) there is an extremely limited ability to fund a shortfall in housing benefit from remaining benefits. People try, of course, but it is, inevitably, uncertain, unreliable and subject to the slightest changing financial demand.

Thanks for the explanation.

The figures do change however if the government takes an axe to child tax credit and working family tax credit, although perhaps not by much. As we know, the notional savings from reducing the OBC are tiny compared to the overall state welfare budget, and as Joe has pointed out, would be more than consumed by the local costs of emergency accommodation. In separate correspondence Joe has dismissed the possibility of the government slashing these tax credits, but it seems that the BBC are flying a kite for Osborne over it. And if the government does not consider this option, obscene as it is, they will not come within a mile of their £12bn target if you look at the IFS figures.

Yes. It would be a perverse way to mitigate the effects of the Cap, but would obviously increase the HB portion.

Robert – If the government decides to halt Child Benefit and Child Tax Credit after the first two children, then (a) for each child additional to this the household loses £67 per week and (b) in this zero sum policy has £67 more in the maximum housing benefit payment.

Not only would this be a perverse way to mitigate their own policy (!!) it would mean that for “work to always pay more” which is the highly spun mantra of the government that a household with 3 children would need to find work paying £67 per week more than the NMW and the household with 4 children would need a job paying £134 per week (both net figures) for work to pay more than benefit.

It would also mean that the 3 child household would receive £67 per week less than “the minimum amount the law says you have to live” which adorns all benefit decisions and £134 per week less than this for a 4 child household and a further £67 per week on top of that for the 5th child etc.

The BBC is being fed from the speculation of the IFS (a Blairite Think Tank) who decided in their infinite wisdom to speculate on this and has been picked up by the BBC and others.

Joe, I agree the government is not going to cut child benefit and the IFS is clearly muddying waters when it suggests this might be a possibility. But the government has not ruled out attacking child tax credits, and they may be hoist on their own petard over this. It seems to me that if they are to get close to their target they have to cut benefits for a large number of people, and I mean millions. Neither the bedroom tax nor the OBC do this – they are a piss in the ocean compared to £12bn. That or attack those who voted for them – pensioners. They are not going to suddenly give up on the target – Osborne’s commitment to balanced budgets precludes this as much as their ideological determination to cut state welfare

Robert

Here is IDS categorically stating that he will not be cutting Child Tax Credits on film 2 days before election

https://speye.wordpress.com/2015/06/02/ids-did-rule-out-cuts-to-child-benefit-child-tax-credits-on-bbcdp-show/

Joe, not quite, Reeves challenges him on tax credits but he initially replies only on child benefit citing Cameron’s statements which as I recall were certainly confined to child benefit. He then concedes that child tax credits will be frozen which leaves plenty of room for manoeuvre. We shall see: we are awaiting Wirral figures to show how many families it thinks will be hit by the lower cap. PS: schadenfreude, forsooth…you will be a linguist yet!

Thanks for this analysis NL, this is really comprehensive (and really depressing).

I am sorry to ask such a stupid question, but it’s a long time since I went on welfare benefits training! But I don’t understand the logic of the benefits cap (that those out of work should not obtain more via benefits than those in work). Surely the whole point of working tax credits, and child tax credits, was that a comparable family who are in work would obtain more overall than if they were out of work?

It’s really grim to see the Labour leadership candidates not acknowledging the implications of the cap, and racing to the bottom with welfare scrounger and anti-immigration rhetoric.

Yes, comparison for £26k cap specifically excluded benefits and tax credits an in work household would receive. Was ‘symbolic’ link at best, and that link broken by £23k cap.

I can add that I have worked with two single people in temp accommodation in recent months who have been affected by the cap. Both have experienced recent and significant sight loss, both on ESA still at assessment rate and with no decision (for a very long time) on PIP applications. TA rents of £315 weekly and £287 weekly have meant they are and were subject to the £350 cap.

“63% of capped households constituted a single parent with child dependants”. About 95% of single parents are women. Indirect sex discrimination?

Yes. But read the bit about the Supreme Court judgment in the last section. That, at least by itself, is not going to be a successful ground of challenge because already rejected.

A closer inspection of who is affected reveals a national average of 57% of those affected being lone parents with children, yet this varies from 41% to 65% in different regions

As I said initially in response the reduction will affect different households in different areas and in different ways and in differing degrees.

It is an extremely dangerous and offensive pig’ ear of a policy that WILL cost the taxpayer billions more per year and the policy has no rhyme or reason other than a political blame game

Excellent analysis and it ought to be compulsory reading for every MP (I am forwarding the link to mine, more in hope than expectation).

I think that any reduction of the cap to an amount no longer linked (however tenuously or symbolically) to average earnings will require primary legislation because that link is enshrined in s96 of the Welfare Reform Act 2012, so there will be an opportunity for parliamentary scrutiny of the issues you have raised and it is unlikely to happen quickly (1 April 2016 would be the absolute earliest date I would have thought).

The reason for the reduction in DHP budgets this year is the reduction/expiry of “parachute” money notionally earmarked for earlier reforms: LHA caps in April 2011 and the first benefit cap in particular. If the benefit cap is reduced to capture more people I would expect a further provision of parachute DHP funding weighted towards the areas where the impact will be greatest (just as the previous tranche was): this will ease the pressure on local authority temp acc procurement spending, a bit.

Just like last time, the government will present this as a work incentive. The easiest refuge from the benefit cap will remain bogus self-employment upon which the fiction of economic recovery is founded (730,000 new businesses my arse). Up to now this is done with a certain amount of connivance from DWP and HMRC. But with the WTC Regs having recently been amended with the intention of making HMRC more discerning about eligibility for WTC and only accepting genuine self-employment, we are heading for a car crash.

As others have said, thanks for the excellent analysis.

What concerns me is how to get the wider public to understand the problems of pursuing this policy?

We know that it is extremely popular with the voting population, and in many cases, any attempt at discussion about the problems with the benefit cap is met with a gambit along the lines of “If they can’t afford to live there, they should move house then”.

There’s also the difficulty in explaining why the comparison used to justify the cap is specious if I’m being kind i.e. a family on the median income would usually also be entitled to extra financial support from the state, thus raising their income.

With the DHP reductions, and the other financial pressures being placed upon local authorities, I’m very worried that people won’t understand what it is they’ve wished for, until we see floods of people rough sleeping and homelessness becoming highly visible.

The government have created a serious problem for themselves by the way the ‘cap’ has been advertised.

It’s clear to me that the original intent was symbolic. A high figure was picked and heavily implied to be, if not outright misdescribed as, the amount of money a person gets on benefits.

Once this path was taken there would inevitably be political pressure to keep bringing the apparently lavish amount down. As a household figure, the level of the cap is entirely arbitrary because the concept of a household is so arbitrary – it can vary in size greatly. A figure apparently representing average earnings of one person obviously has little relevance to a household of eight people. A welfare system that pays based on a household obviously needs to consider the size of that household, which the cap does not.

In 2009 the Conservatives said they would ‘end the couple penalty’ in the benefits system. Not only have they done nothing at all to do so, the benefit cap is a best thought of as a supercharged couple penalty – not only incentivizing couples to separate, but now also those with large households to offload their children into another ‘household’ in order to keep the level of benefits available per person above the level of total destitution – a perverse incentive by any conceivable definition.

This is going to cause severe problems for everybody and increase teh cost to the state, but because of the way the cap has been habitually falsely advertised both as some form of guaranteed minimum benefit level, and as a personal amount, it will be politically impossible not to reduce it without exposing that deception.

Has anyone researched the adverse mental and physical health implications for both adults and children implicit amid such social carnage? The poor and vulnerable are being treated like livestock. This journalistic angle, if highlighted, would bring home the wanton suffering, torment and social dislocation. The nation needs to be alerted to this level of cruelty and and lack of compassion unworthy of a civilised country. The government is abusing the poor and vulnerable in the redolent form of Neronian sport.

Just a small correction if i may, but the rents for social landlords (RPs) are to reduce by 1% per annum for next 4 years, from 2016. and their is a cap on new rents. And that is what We have implimented this year [Welfare Reform and Work Act 2016]

Excellent piece as usual though. Thanks

Yes. This post is from June 2015.

Sp *THERE* Doh!

oops so it is Giles :)