Further to my post here on council tax liability for statutory periodic tenancies, I have heard about another Valuation Tribunal case, this time involving a contractual periodic tenancy, and also oddly involving this blog.

The issue was council tax liability for a period where a tenant had left a property before the tenancy was ended and the tenancy was a contractual periodic. The tenancy agreement specified a 12 month fixed term followed by a monthly periodic.

The Council, Shropshire Council (to whom we will return below) considered that this meant that the landlord was liable for the Council tax for the relevant period, as per CT v Horsham District Council (HB) [2013] UKUT 617 (AAC).

The landlord was clearly annoyed at this and appealed, for roughly a month of CT liability.

The Valuation Tribunal (Decision here, appeal no 3245M131738/176C ) decided, quite rightly in my view, that a contractual periodic tenancy, following on from a fixed term, was a continuation of the same tenancy. The tenancy was, contra Shropshire’s arguments, for a sufficiently certain period and, given the tenancy agreement , was clearly for a period of over six months. Thus, the tenant’s interest was for over six months and the tenant was liable for the council tax, not the landlord.

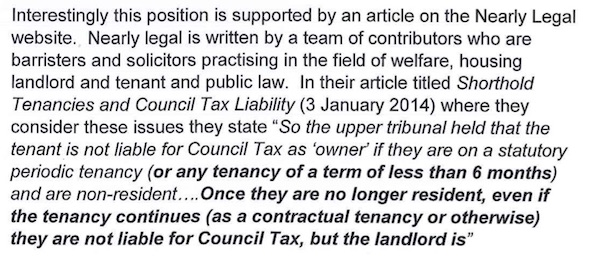

While this clarification is useful, what amuses me about the case is that Shropshire included Nearly Legal and my earlier post in their evidence relied on in support of the case. Shropshire put it this way:

Aside from the sheer nonsense of putting NL material in as evidence on any legal position, I don’t think that does actually support Shropshire’s case, even in this edited version. But what raised my eyebrows is the very selective editing that has gone on. Those are my words, but the ellipsis completely changes the significance of the last sentence. What I actually said was

So, the Upper Tribunal held that the tenant is not liable for Council Tax as ‘owner’ if they are on a statutory periodic tenancy (or any tenancy of a term of less than 6 months) and are non-resident. The liability will fall on the next ‘owner’ up the chain with a material interest and a longer than 6 month term, usually the landlord.

The Claimant in this case was found not to have received an excess of CTB. Unfortunately, that was because she had no council tax liability and should have received no CTB at all.

As far as I can see, this should also apply to any secure or assured social tenant on a weekly or monthly periodic tenancy. Once they are no longer resident, even if the tenancy continues (as a contractual tenancy or otherwise) they are not liable for Council Tax, but the landlord is.

The reference to a contractual tenancy in the last line was to a secure or assured tenancy, periodic from the very start, where security of tenure had been lost through tenant not being resident. Shropshire quote and emphasise it as a reference to contractual tenancies in general, seeking support for their position on the contractual periodic in this case.

Naughty Shropshire. Don’t go selectively quoting me again.

Thanks for post and information GP

Much appreciated

Might I push the bounds and ask for your comments about initial terms and contractual periodics and tenants deposits. I am being told that when an initial term expires but the tenant continues month to month under the original term granted, the landlord must re-register his deposit and re-serve prescribed information at the end of the initial term. I am being quoted s5, Superstrike and Gardner vs McCusker. It seems those cases all dealt with stat periodic agreements and not contractual periodics. It seems to me that if the term has not expired then there is no need to re-serve as there is no new agreement.

I agree with you. Indeed, that is why some people are using ‘fixed term becoming periodic’ contracts, to avoid possible Superstrike liability.