This is something I’ve been mulling over for a while, and have sounded off about in conversations, but the ongoing proliferation of housing disrepair claims farmers (and associated solicitors) has pushed me to go public with something of a rant. A justified one, I believe.

The reason for the rant is that these set ups are bad for tenants, bad for responsible and ethical claimant solicitors, and bad for social (and occasionally private) landlords in ways that should concern all of us, not just the landlords. Claims farmers (and sadly some solicitors firms, mostly ‘new entrants’ to the area) appear to believe the disrepair is the new RTA or ‘trip and slip’, ready for unskilled bulk claims. It really, really isn’t.

What are claims farmers?

Or as they prefer to be known, ‘claims management companies’. They are not legal practices, despite what they might like to suggest. They certainly like to claim expertise.

(They haven’t got any solicitors. And they certainly shouldn’t be saying that unsuccessful claimants will not have to pay a penny.) Or

Or

Or

Or

They have no need of, and usually possess no legal qualifications whatsoever.

They are, somewhat, regulated. Initially, claims farmers, including for disrepair, were required to register with the then Claims Management Regulator. As of 1 April 2019, that function passed to the Financial Conduct Authority. (Not all claims farmers seem to have caught up with this yet, despite a 31 July 2019 deadline to apply..).

The FCA has recently proposed and implemented a new set of rules. These are interesting and I’ll come back to them below.

What claims farmers do is very limited. They’ll take an initial description (often without really understanding the technical issues of disrepair law, or maybe without checking on things like arrears levels, or existing possession proceedings/suspended possession orders and so on, which would entitle people to legal aid). They might get a surveyor or ‘expert’ in to inspect (there are questions about these experts, and indeed how they are selected. Any responsible solicitor should want to control this process, and comply with the pre-action protocol). They might do an initial letter. But that is about it. At that point, if not before, the tenant claimant is referred to what is often described as ‘one of our panel of solicitors’ (There rarely is actually a panel. It is usually only one firm, if there is one at all – again I’ll come back to this below).

For that, the claimant tenant will either have to pay a fee from their damages at the end of the claim, or the solicitor will pay a referral fee, which the claimant tenant will effectively, if indirectly, pay out of their damages at the end of the claim (see below on levels of success fee).

So, very limited actions, all of which should properly be done by solicitors in the first place, and should not result in any additional costs to the tenant claimant. A claimant tenant who goes directly to a responsible solicitor will not pay these extra costs and will have any and all of these steps carried out properly, not at the mercy of the unqualified, chasing their referral fee.

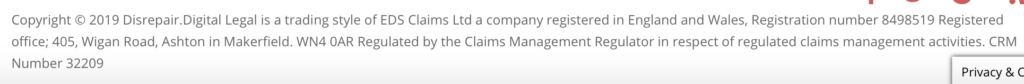

For some reason, most, though not all, of the claims farmers seem to be based in the North West (Manchester, Liverpool etc). But they are advertising extensively on Facebook on a national basis. For example

There seems to be some confusion as to whether it is up to £20,000 ‘in compensation and repairs’ or £10,000 in compensation. This may be because they don’t know what the hell they are talking about.

Or another ad saying

Recommend a friend to Disrepair.Digital Legal who is living in a council house or housing association who is suffering from disrepair and they need help we will pay you £50.00 once there (sic) case is accepted by our legal team.

Our specialist panel of solicitors are experts in their field of housing disrepair claims and will offer you a fast and friendly service and a no-nonsense approach to your claim. Landlords are obliged by law to ensure the property, which they rent to you, is habitable for you to live in.

(Don’t even start me on that last bit).

And there have been outbreaks of large scale leafleting of London council estates.

The murky bits

Where things get particularly unclear is where claims farmers have a relationship, a very close relationship, with a particular firm of solicitors.

Let me give you a couple of examples.

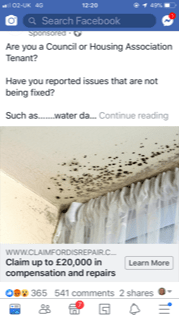

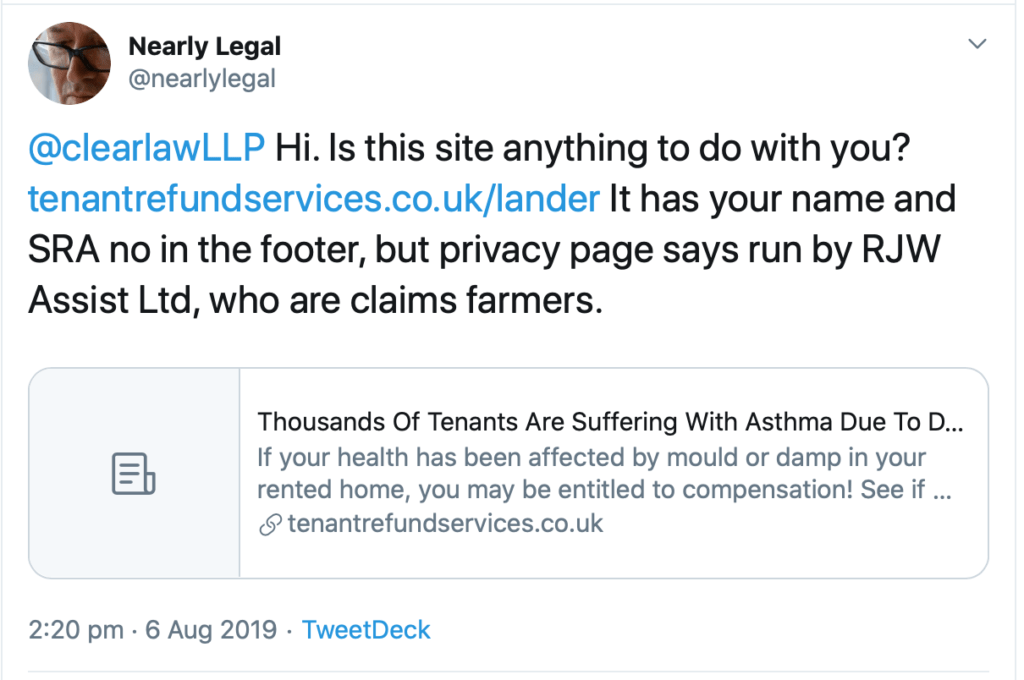

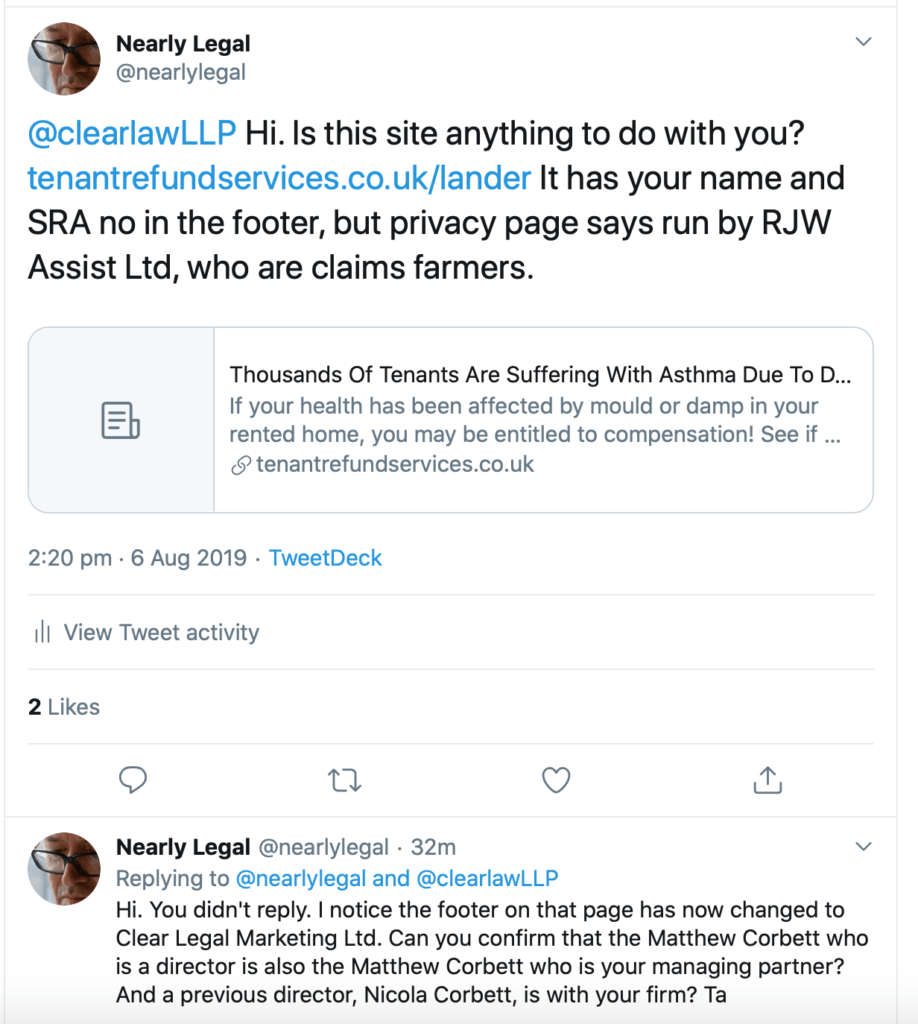

While working through the morass of disrepair claims farmer websites to prepare this post, I came across ‘tenant refund services‘. The site was rather odd. On the landing page, the footer said that “disrepairclaim.co.uk” was a trading name of Clear Law LLP, with SRA number and a statement that fees would be 50% of compensation (we’ll come back to this). But the link to the privacy policy led to a page saying that “tenantcaseworth.co.uk” was a trading name of RJW Assist LTD, who are a claims farmer set up.

Puzzled by this, I asked Clear Law LLP whether they had anything to do with “tenantrefundservices.co.uk”

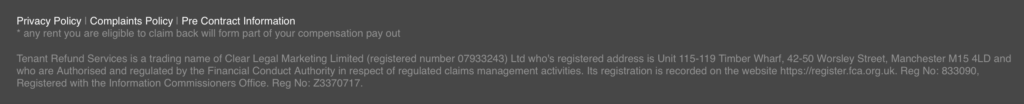

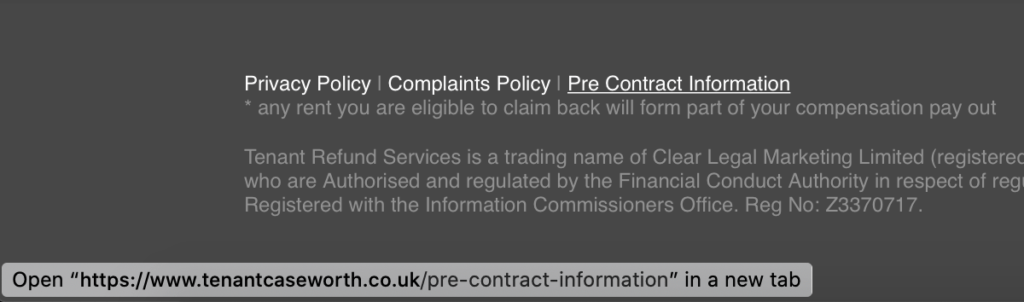

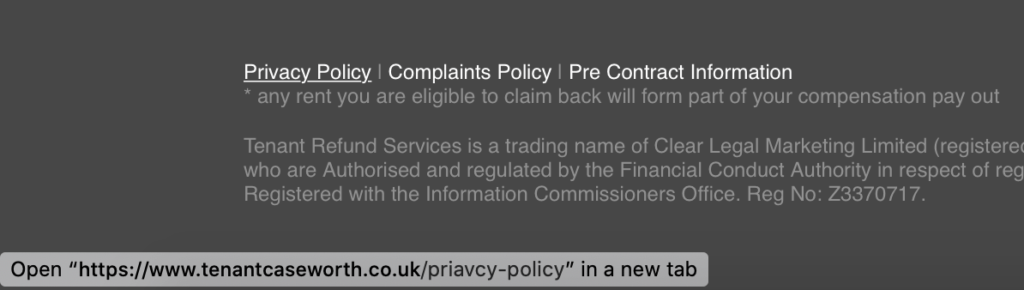

I did not get a response. But the next time I looked, the footer to “tenantrefundservices.co.uk” now said “Tenant Refund Services is a trading name of Clear Legal Marketing Limited”.

So, off to look at Clear Legal Marketing Ltd I went. A current director is a Matthew Corbett. Oddly enough, the managing partner of Clear Law LLP is called Matthew Corbett. A former director of Clear Legal Marketing Ltd is a Nicola Corbett. A Nicola Corbett is a solicitor at Clear Law LLP who “oversees key strategy, operations and workflow planning”. The largest single shareholder in Clear Legal Marketing Ltd is a Matthew Corbett. According to the Law Society, the only solicitor at Clear Law LLP who is a member of the LLP is a Matthew Corbett (the other members are companies).

I asked Clear Law LPP to confirm whether these Corbetts involved with Clear Legal Marketing were both the same Corbetts as their Corbetts. I have not had an answer.

Funnily enough, the ‘Terms and Conditions’ page of tenantcaseworth.co.uk, which is according to the footer a trading name of RJW Assist LTD, is actually a Clear Law LLP conditional fee agreement (yes, really – screenshot and pdf for when it inevitably vanishes). The ‘privacy policy’ link for tenantscaseworth.co.uk leads to a page on disrepairclaim.co.uk which says that “‘Disrepair Claim’ is a trading style of RJW Assist LTD”.

And then the ‘pre contract information’ link in the footer of “tenantrefundservices“, the Clear Legal Marketing Ltd site, still leads to a page on the “tenantscaseworth” site supposedly run by RJW Assist Ltd, as do the privacy policy and complaints policy links.

So, we have Clear Law LLP somehow involved in a number of claims management sites, at least one of which is (now) apparently run by a claims farmer which has Clear Law’s managing partner as a director, and had the involvement of another Clear Law senior solicitor. And, until I poked my nose in, who was behind which site was even more confused than it is now.

Now, disrepairclaim.co.uk and tenantcaseworth.co.uk both claim they are paid by a referral fee from solicitors (I wonder which solicitors…)

DisrepairClaim will not charge customers any fees while providing this service. If a solicitor accepts your claim in order to purse compensation for you, we will receive an introduction fee from the solicitor for our work. This fee will not affect the value of your compensation and is paid to us upon the time of you signing your CFA (conditional fee agreement).

According to Clear Legal Marketing Ltd, via the tenantcaseworth page:

As far as I can see, that is a solicitors firm, which is an LLP of which Matthew Corbett is the sole non company member, paying a referral fee to a claims farmer company of which Matthew Corbett is a director and the largest single shareholder. One does hope that relationship is clear to their clients.

Remember that 50% success fee charged against the claimant tenant’s damages by Clear Law LLP? Keep bearing that in mind…

Another example. Housingdisrepairhelpline (HDH) is a London based claims farmer, who announce ‘free housing advice’ (it isn’t free).

Also, you know, they really shouldn’t say things like “in the event of a loss… there will be no cost to the client at all” (Even with ATE you can’t say that. It is irresponsible to do so.)

The company behind the HDH site is Flybell Limited. There are two directors of Flybell Limited, one of whom is an Arthur J A Barnes. Arthur J A Barnes is was also a 50% shareholder [05/09/2017 Correction It has been raised with me, though not by Mr Barnes directly, that he is no longer a 50% shareholder. On further interpretation of Companies House records, this is true. He was a 50% shareholder from the founding of the company in 2015, but it appears that at some point in 2018, his share was transferred to his co-director. Mr Barnes remans a director of Flybell Ltd]. Arthur J A Barnes is also a solicitor at Clarke Barnes. His practice is largely ‘housing disrepair’.

Now HDH’s site is silent on how, exactly, they get paid. But they do get paid, as in the year to April 2017, they declared £198,440 in turnover. So let us assume a referral fee.

So, once again, we have a solicitors firm paying referral fees to a company in which a partner of the firm is a director and is was a shareholder.

It may not surprise you to learn that Clarke Barnes also charges 50% success fees against the damages for its disrepair claimant tenant clients. [Mr Barnes has contacted me. He informs me that his firm now charges a maximum success fee of 50% of general damages only, and does not always charge that rate of success fee.]

Just as a reminder, here is Indicative Behaviour 1.4 from the SRA Code of Conduct for solicitors.

IB(1.4)

explaining any arrangements, such as fee sharing or referral arrangements, which are relevant to the client’s instructions;

Oh and another site homerepairscheme.org.uk is run by Mckays Solicitors Ltd, (again, a north west practice) but the site fails to give their SRA number anywhere, which is a regulatory requirement.

An excursus on success fees

Blame the Government. The Legal Aid, Sentencing and Punishment of Offenders Act 2012 accomplished two relevant things (actually three, but we’ll come back to the third).

Firstly, legal aid for disrepair claims was effectively scrapped by limiting availability to claims for urgent risks to health only, not any accompanying claim for damages or lesser disrepair.

Secondly, success fees – previously recoverable from the defendant – now had to be taken from the claimant’s damages award.

So, funding for disrepair claims was pretty much limited to conditional fee agreements (CFAs), where the success fee could only be recovered from the client’s damages at the end.

But, but, but… success fees are necessary for CFAs.

There will always be claims that don’t progress. For example where the expert report confirms that there is no actionable cause for the conditions that the tenant complains of. But by that point, time costs have been incurred and expert’s fees have been paid out, and are not practically recoverable from anyone.

And then a CFA means that even if successful, the claimant solicitor won’t see payment for a very long time, possibly months after the end of the case, which might itself have taken a year or more. During that time, there have been payments out – expert’s fees, court fees – and much work done.

So, the claimant solicitor is facing unrecoverable costs on non-progressing cases, and a long delay to payment.

This means that without a success fee, claimant solicitors will be operating at a loss on CFAs overall. This is not sustainable. So, success fees are necessary. Ugly but necessary.

However, thanks to LASPO, success fees taken from damages impact on clients who often are of low income and have little else. There is a balance to be struck.

Personal injury success fees are limited by statute to a maximum of 25% of damages. As a basic principle, that seems a not unreasonable trade off. For non-PI cases there is no such limit, but on a fairly standard disrepair case, there is no real reason to depart from that 25% measure.

Cases that have an unusually high degree of risk – either legally or in additional ‘at risk’ investment by the solicitors in fees and expenses – might reasonably involve a higher success fee. I can even conceive of situations where 50% would be justifiable. But that is the exception, not the rule. In a well managed and reasonably skilled disrepair practice, there is no reason for success fees to exceed 25% on a typical disrepair claim.

Which brings us back to those 50% success fees (on all damages, or on general damages). I think we can tell where the referral fee (sometimes paid to a claims firm that is effectively owned by the solicitors charging the success fee) comes from. It comes from the client’s damages.

It is worth noting there have been successful challenges by claimants to the amount of capped success fees where it was not based on a properly risk assessed proportion of legal costs – eg. Herbert v HH Law Ltd (2018) EWHC 580 (QB). A flat charge of 50% of damages can’t really stand.

It is also worth noting that where there are threatened or actual rent arrears possession proceedings, and the tenant is eligible for legal aid, a CFA is not appropriate as a means of funding, as legal aid will fund a counterclaim in full. There would be a strong argument that a failure to advice a tenant that they should obtain legal aid would render the success fee on a CFA unrecoverable.

Full circle

At the very best, using a claims farmer means additional costs to the tenant claimant for no additional benefit (none at all, not a one).

At the worst, it means that the tenant claimant ends up paying for the solicitor’s marketing activity through the ‘outsourced’ claims farming company in which the solicitor has an interest. Is this relationship declared? It should be. I would hope so. But there are suspicions. Eg Clear Law LLP aren’t clear upfront about their relation to claims farmers, even the one owned by their managing partner. HDH go on about their ‘panel of solicitors’ but it appears that it is largely Clarke Barnes to which they refer. I don’t think it is any co-incidence that both firms charge 50% success fees (on all damages or on general damages) to their client tenants.

The PI example

It is worth remembering that amongst all the horrors that LASPO inflicted, there was also a ban on paying referral fees for PI claims, on the basis that they were increasing the costs of litigation, and a cap of 25% of damages on success fees.

This now sounds all too familiar….

Why is this important?

Well, one might think, some claimant tenants are being ripped off, but is this a big deal?

Yes, I’m afraid it is. The damage is not just to the tenants, though that is bad enough in the extra costs taken from them by way of the large success fee.

Landlords are facing poor, badly founded or erroneous claims. Now I have no sympathy for landlords where is there is a good claim, none at all, but dealing with a swarm of poor claims costs them and, at least for social landlords, that is money that could be put to better use.

Some social landlords adopt a policy of just settling any claim – my view is that this is an error – but even a policy of fighting the poor claims will cost them in the shorter term. Bad claims should not be brought. The job of a competent claimant solicitor is to filter prospective claims. Claims farmers by and large do the opposite.

Bad claims also help make the case that the claimant sector as a whole needs to be dealt with (exactly the argument that insurers made against PI firms and, despite the evidence, continue to do so). Competent, responsible claimant practices suffer accordingly. (This is not about competition for work, though. There is no shortage of work in disrepair claims.)

What is to be done?

Bluntly, I think the PI restrictions – including a ban on referral fees – should be extended across the board, or at least certainly to housing disrepair.

Maybe the SRA could step up investigations on potential breaches of IB(1.4) by solicitors.

IB(1.4)

explaining any arrangements, such as fee sharing or referral arrangements, which are relevant to the client’s instructions;

The new FCA regulatory rules for claims management companies look interesting. For example

We maintain that CMCs must include details of a termination fee in financial promotions that use the term ‘no win, no fee’ or similar. This reduces the risk of a potential customer not realising they may still have to pay a termination fee if they decide to end the claim after the expiry of the cooling off period.

Related, the potential termination fees of any firm to which the client is referred:

Clarified the requirements for lead generators when using the term ‘no win, no fee’. Lead generators who do not know the fee of the firm they are referring to must give an indication of the fee that the customer may need to pay. Lead generators must also provide details in the financial promotion about any termination fees which exist. If they are unsure of the termination fee, for example they do not know which firm the customer will be referred to and therefore the fee that will be charged, they will need to state that a customer may have to pay a termination fee.

And

We consider that where the customer pursues a claim that has the effect of reducing a liability owed, there may be some value to this pursuit and so it would be legitimate for a CMC to charge a fee. We are requiring CMCs to make the customer aware of the possibility that the customer might not receive any redress directly from their claim, as it will be offset against the liability, and would therefore still have to pay the CMC fee from their own funds. This would help customers make a fully informed decision about whether to engage the services of a CMC.

This last is particularly important for disrepair claims where there are rent arrears, for example. I have been told, anecdotally, that claims farmers don’t always adequately advise on rent arrears and the issue of a set off against damages, or even ask for that information. And, even worse, that some solicitors don’t properly risk assess and factor it in, and then actually pursue claimant tenants for the success fee where damages don’t meet it because of an arrears set off. I don’t have any evidence of this happening beyond anecdote, but if it does, it is disgraceful. Again, if there are threatened or actual rent arrears possession proceedings, the tenant should be advised to seek legal aid for defence and disrepair counterclaim. The success fee may well be unrecoverable if this advice was not given.

None of the claims farmer sites I have looked at have made any mention of potential termination fees, either by the claims farmer or the solicitor that they refer to, but of course CFAs routinely include a requirement that a client who withdraws (after the termination period) will become liable for the firm’s legal costs.

So, it may be that the FCA’s rules will improve behaviour, in the future, if the FCA is willing to take action on complaints.

But that doesn’t address the issues of referral fees, which should be banned, and high success fees.

Should there be a PI style restriction on success fees to say 25% for disrepair? I rather think that this would restrict solicitors taking on riskier, or more up front expensive cases. Flexibility in success fees is important for that. But I will confess that the activities of some firms makes that argument much harder to maintain.

I won’t go into the arguments about fixed costs, save to observe that the current proposals are likely to mean decent firms abandoning the sector and leaving only the claims farmers and inexperienced poor solicitors working on those claims, who believe this is the new RTA (disrepair is much more complicated than that). Fixed costs won’t be the answer, quite the reverse.

And oh, yes. Reinstate legal aid in full for disrepair/housing conditions claims. That will remove the claims farmers at a stroke. And at no costs to the legal aid fund over time, as costs are recovered.

Notes for tenants with repair or housing conditions problems

- Don’t go to a claim farmer. That simply adds costs with no benefit.

- Go directly to a solicitor with expertise in disrepair.

- If the success fee on a conditional fee agreement is over a cap of 25% of damages, the solicitor had better have a very good reason why.

- If you are facing threatened or actual possession proceedings for rent arrears, it is quite likely that legal aid would be available to fund a defence and a counterclaim for disrepair, with no success fee. You should be advised of this before being asked to enter a conditional fee agreement. You should not enter the conditional fee agreement.

Sources of the claims farmer screenshots

disrepair.digitallegal.co.uk

www.tenantcaseworth.co.uk/optin-31257579

www.tenantrefundservices.co.uk/lander

www.disrepairclaim.co.uk/housing-disrepair

claimfordisrepair.co.uk

claimfordisrepair.co.uk/about-us/

homerepairscheme.org.uk/index.html

we received a purported claim for one of these last week. We (an LA) dont even own the property, so it appears that not event he most basic of checks are being made before intimidating letters are drafted…

Oh how funny. PPI is dead long live costs because costs is what it’s all about. Yet one more to feed on the rotting carcass of local government. Is there really a difference between fee farmers? Can you really be ethnically minded when you vigorously pursue an action through the Courts that could be settled by mediation? But then, there’s no money in mediating. Still it must be concerning to have so many sharks circling the place where you have fed so well for so long.

Oh I’m always open to ADR. Never actually had it proposed by a defendant though. And quite what is to be mediated when the issue is undone works isn’t clear.

And as I said, there is no shortage of work. This is not a complaint about competition, for heavens sake.

I’m a lawyer who has been working in this sector for all of my admittedly short legal career. I’ve worked for firms in the past that charge a 50% success fee and have questionable relationships with the referrers – thankfully, the firm I work for now has a reasonable success fee and sources clients using more legitimate means.

Housing disrepair claims and the firms that deal with them have gained a bad reputation as a result of door-knocking referrers and firms that will progress a high volume of weak claims in the hopes of early settlement. This also has a negative impact on social tenants, as those who do wish to make a claim are often cast in a bad light.

It seems to me that it is the claims management companies referring the cases who view housing disrepair as the new RTA, along with a few other types of claim such as CWI and mis-sold mortgages. However, it is clear that social tenants (along with most other tenants) are in need of housing disrepair claims to keep landlords in check. A balance needs to be struck – fixed fees are not the answer, but your suggestions regarding success fees and referrers properly informing clients is spot on.

Another thing to keep an eye on is to check who they propose as SJE

Anthony Hodari Solicitors like to suggest Ultima Legal Services for Single Joint Expert…

Anthony Hodari IS Ultima Legal Services… so not exactly independant or unbiased.

ULTIMA LEGAL SERVICES LIMITED

Company number 08353248

HODARI, Antony Victor

Correspondence address

34 High Street, Manchester, United Kingdom, M4 1AH